The New Rules of Holiday Readiness

The

NEW RULES

of Holiday Readiness

Industry experts share insights, strategies, and expectations for the season

Featuring the eTail 2018 Holiday Checklist

INTRODUCTION

When it comes to the holidays, some things never change—but your customers’ expectations aren’t one of them. If your plans for holiday readiness haven’t changed much over the years, you may miss out on opportunities to increase year-over-year sales during the time you need them most.

Every year, retailers roll out special offers for the holiday season to keep their customers interested. While retailers reporting excellent Q4 2017 results expect to replicate similar strategies in 2018, all retailers need to deliver even greater results than before. Success on today’s complex, competitive landscape requires this growth.

With changing customer expectations come changing trends. Retailers that understand consumer habits must start now to adjust their strategies accordingly. So, what have you done to learn more about your customers, and how are you transforming internally to deliver new, ideal customer experiences?

The New Rules of Holiday Readiness features key insights and data from 167 retailers as they prepare for Q4 2018. We’ve tapped leaders from the best brands in the business—Ralph Lauren, Best Buy, ACE Hardware, and more— for their insights on the most important new approaches for holiday retail success. Finally, we’ve leveraged the results for our easy-tomanage checklist—the greatest gift a holiday retailer could ask for.

KEY FINDINGS

35% of retailers consider their sales performance during the 2017 holiday season to have been only adequate, in need of improvement, or poor, meaning they fell short of all expectations.

64% of retailers are preparing internally to meet customer expectations this holiday season by transforming marketing to become more agile and customer-focused— the most popular choice among five methods for internal preparation.

79% of retailers will use video to drive engagement, acquisition, and conversion during the holidays; among them, 15% of retailers will use video for this purpose only during the holidays.

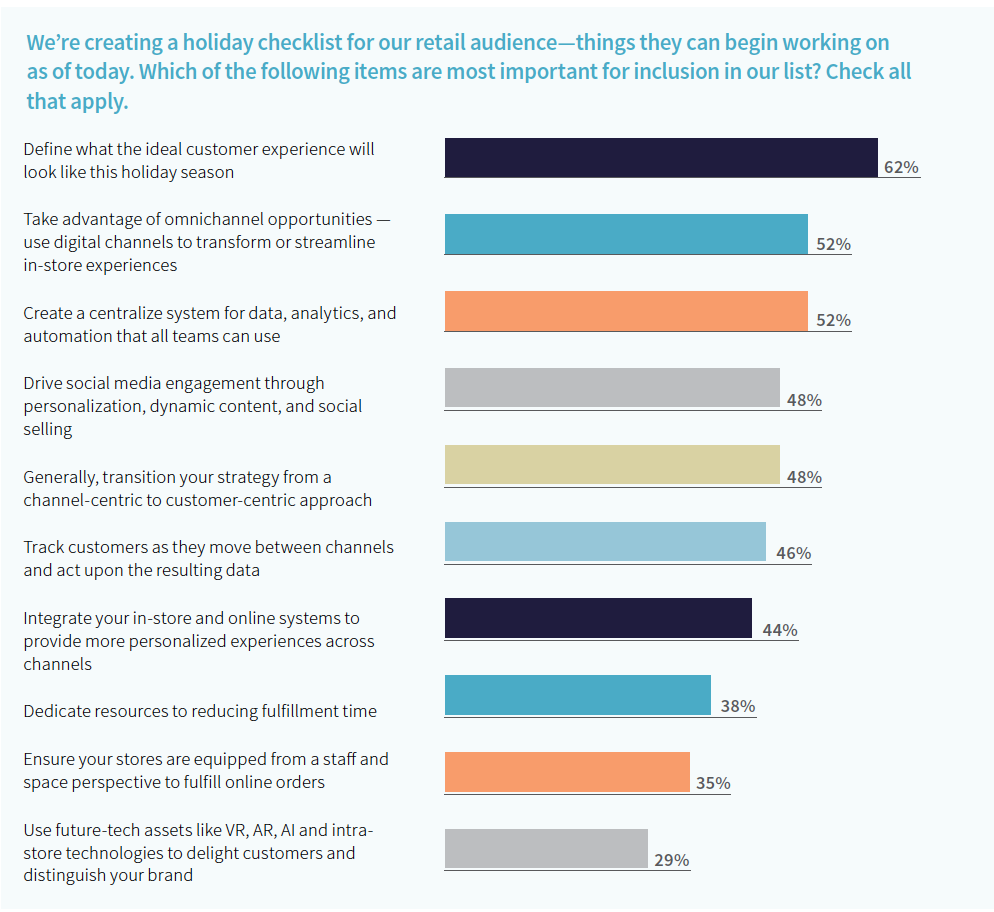

Retailers voted Define what the ideal customer experience will look like this holiday season to the top of the eTail 2018 Holiday Checklist.

ABOUT THE STUDY

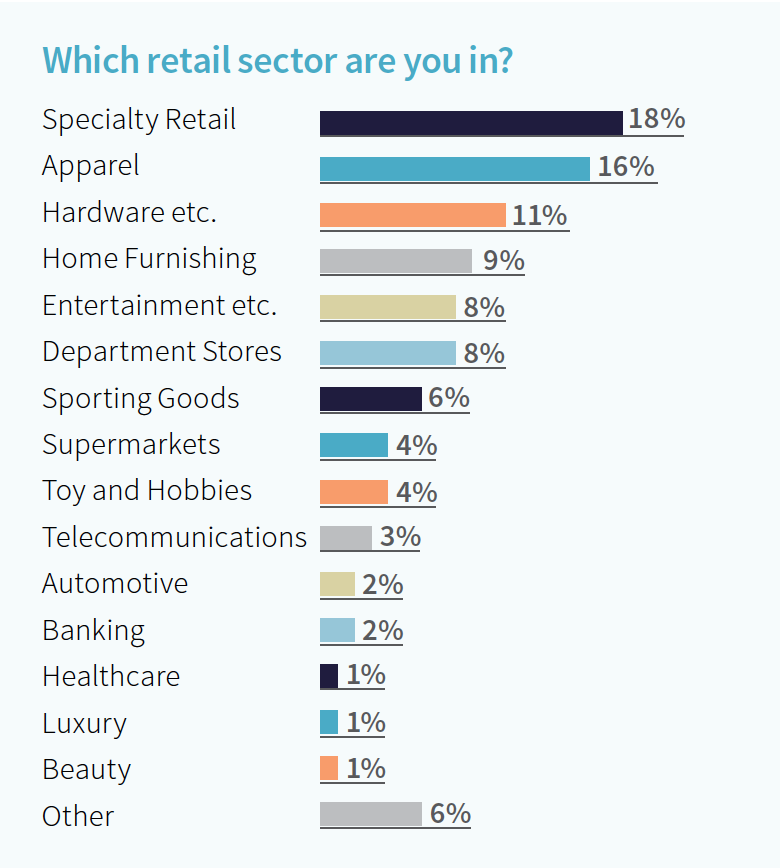

Researchers measured a comprehensive landscape to identify prevailing trends and received direct responses from leaders representing multiple verticals. Most of our 167 respondents identify their retail sectors as specialty retail (18%); apparel (16%); hardware, electronics, and appliances (11%); or home furnishing (9%). Entertainment, food, and travel (8%); and department stores (8%) are also represented.

Fewer retailers identify their retail sectors as sporting goods (6%), supermarkets (4%), toys and hobbies (4%), and telecommunications (3%). The remaining retailers—each under 3%—are automotive, banking, healthcare, luxury, and beauty. Six percent of retailers are in other retail sectors.

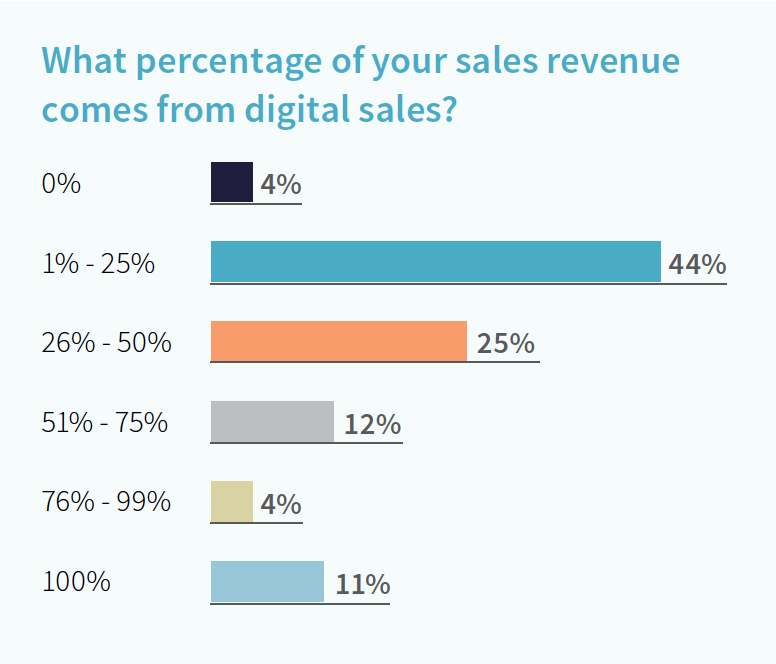

Almost half of retailers (48%) receive 25 percent or less sales revenue from digital sales throughout the year, among which 4% sell only in physical stores.

Most other retailers receive either 26 – 50 percent (25% of retailers) or 51 – 75 percent (12% of retailers) sales revenue from digital sales.

Another 4% of retailers receive 76 – 99 percent, or nearly all, of their revenue from digital sales. Finally, 11% of retailers in the study receive 100 percent of their revenue from digital sales.

Throughout the report, we’ll consider customer experiences involving digital interactions, as well as in-store strategies such as fulfillment, empowering staff, and integrating in-store systems to provide more personalized experiences.

USER SUCCESS STORY

Writey gives you the freedom to have whiteboard productivity anywhere. To deliver on-brand to their customers, they use ShipStation to maximize their ecommerce shipping efficiency.

WRITING ON EVERYTHING

WriteyBoard was born out of a garage in Los Angeles, California. College students with big ideas needed more creative space than the library offered. They needed a whiteboard, but couldn’t find an affordable or accessible dry-erase product.

Designed to liberate your wall, Writey created stick-on whiteboards to collaborate anywhere. Writeyboards were one of the first products to revolutionize dry-erase products for consumers. Soon after its inception in 2010, Mark Cuban invested in the young company.

WRITING ON EVERYTHING

EFFICIENCY FOR ALLWith Mark Cuban Companies on board, the team was ready to scribble out the competition. Despite a high demand of orders, there wasn’t a reliable ecommerce system in place. When searching for a shipping software, it had to meet the following requirements:

- Integrate with Shopify

- Increase productivity and efficiency

- Offer branding features

Before, they were bound to a database hosted on a single computer. “It was a nightmare,” says Jared Jackson. “If that computer couldn’t connect, we weren’t shipping.” Needing a dependable fulfillment solution, they chose ShipStation as their cloud-based shipping platform.

LIBERATE YOUR WORKFLOW

In 2013, Writey erased their old ways of fulfilling orders. “ShipStation couldn’t make it easier to connect to Shopify,” Jared says. The integration setup only took a few clicks. Orders feed from Shopify into ShipStation where they create shipping labels. When shipped, customers receive an email that takes them to a branded tracking page.

The easy-to-use interface helps the Writeyboard team use several features without getting overwhelmed. From accounting to customer service Jared says “everyone at our company uses ShipStation.” Reporting features and insights on the mobile app are vital to staying on top of their business. “The array of reports that ShipStation can generate is really impressive.”

BOOST BRAND AWARENESS

Since 2013, Writey’s product line has grown to include paint-on whiteboards, desks, and accessories. Disrupting an old industry, Writey aims to solidify themselves as a modern, contemporary brand.

HERE’S WHAT RETAILERS LEARNED FROM LAST YEAR

Nearly all respondents made a point to note their specific setbacks from Q4 2017. But these retailers also shared how they are learning from those shortcomings, taking steps to ensure they have healthier results in Q4 2018. They acknowledge a need to ramp up their efforts for a more robust customer experience, and stick to all schedules established as part of their holiday strategies.

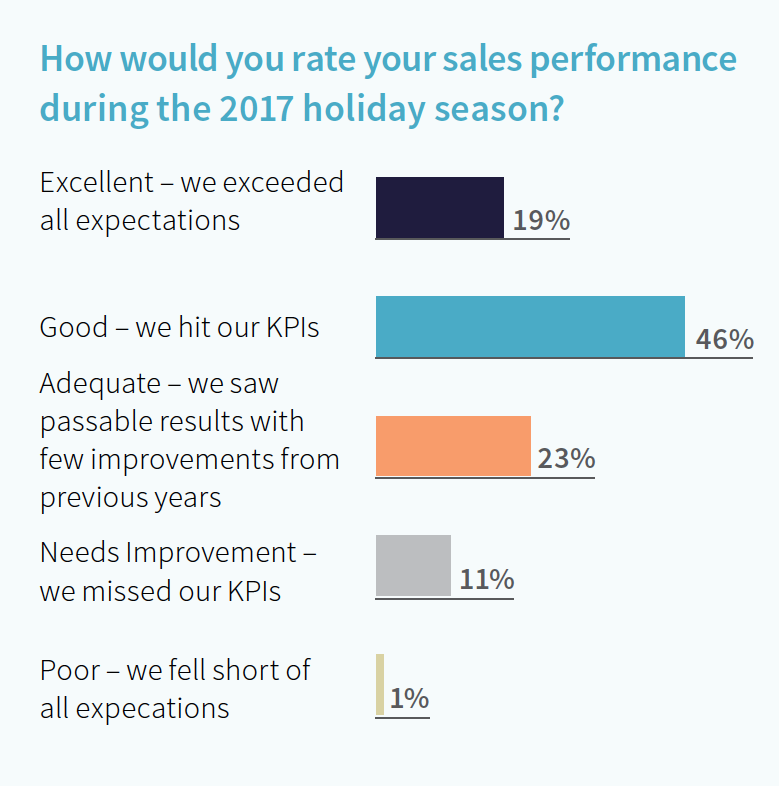

Still, most retailers (65%) report positive results. Nearly half of retailers (46%) claim they hit all of their KPIs, and 19% claim they exceeded all expectations.

35% of retailers consider their sales performance during the 2017 holiday season to have been only adequate; in need of improvement; or poor. Among them, 23% claim they saw passable results with few improvements from previous years. Eleven percent missed their KPIs, and 1% claim they fell short of all expectations.

Most retailers express strong positive attitudes and openness about making changes where necessary. As we will find, taking an integrated, customer-centric approach to improving online and offline environments is a key motivator for their success.

Specific setbacks retailers faced during the 2017 holiday season:

- Trouble fulfilling delivery and production loads

- Fragmentation of omnichannel strategies

- Downtime due to increased web traffic

- Inventory ranges that were too slim

- Execution too late in the season

- Marketing tactics that weren't driven by data

- Not enough testing and experimentation

- and more

BUILDING FOUNDATIONS FOR HOLIDAY SUCCESS

Retailers acknowledge they face greater expectations for personalized, digital experiences that integrate online and offline channels, enabling customers to ‘buy how they want to buy.’ Most retailers are optimistic about providing digital incentives, value-added opportunities like in-store events, providing a full shopping experience with online and offline integrations, and closing gaps in the customer experience with strategic partnerships.

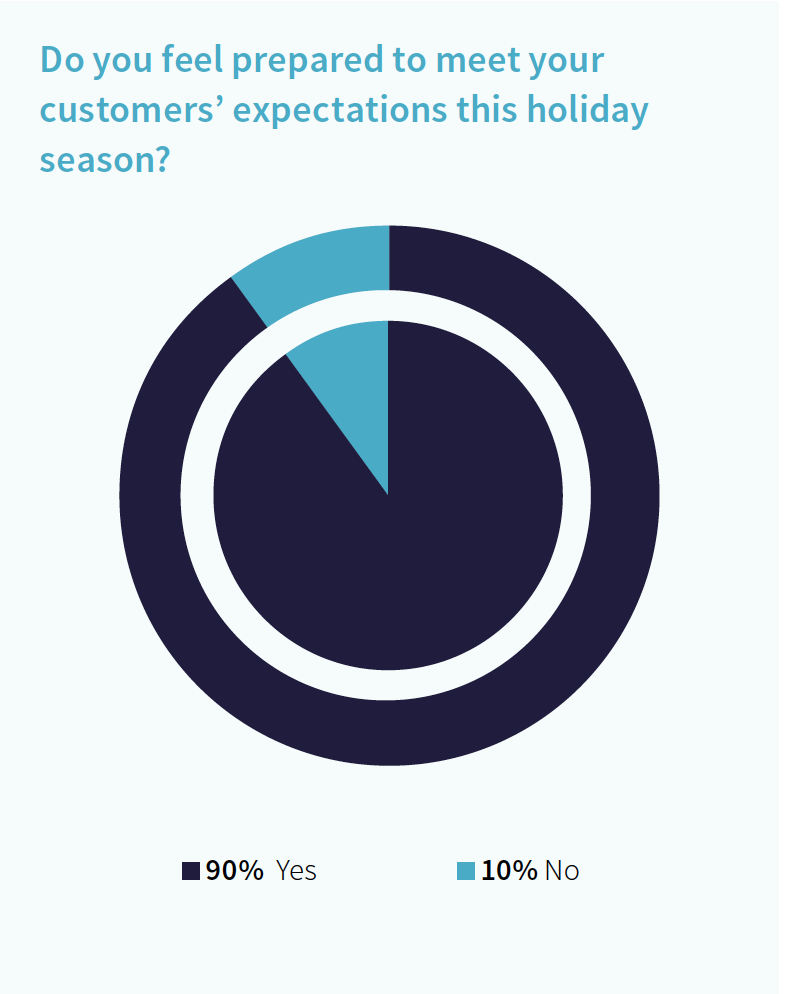

Despite shortcomings in 2017, 90% of retailers feel prepared to meet customers’ expectations this holiday season. Upon aligning this with last year’s performance data, we find that 25% – 35% of retailers—now feeling prepared to meet customers’ expectations—had only adequate, inadequate, or poor performance during the 2017.

According to their responses, effective channel distribution and channel integration are central to approaching customer satisfaction. Customers no longer rely on limited channels but are scattered across many, so that it is essential to provide seamless service across them all.

Several retailers also see the holidays as a chance to leverage digital channels to drive customers to in-store events and involve them in real-world activities. According to one retailer: “Especially around the holidays, people like to get out and mingle, so this is a great way to engage them around the time.”

As a result, retailers are integrating digital and in-store experiences, even incentivizing in-store pickups of large-volume orders— leveraging digital and physical channels to streamline big holiday purchases.

INTERNAL TRANSFORMATION

Retailers acknowledge that enabling customers to ‘buy how they want to buy’ across channels requires internal changes. Our findings suggest retailers are already getting into the spirit. For example, retailers in the study highlight efforts to cut down on internal costs by making processes simpler and efficient, allowing them to offer a higher discount range to customers.

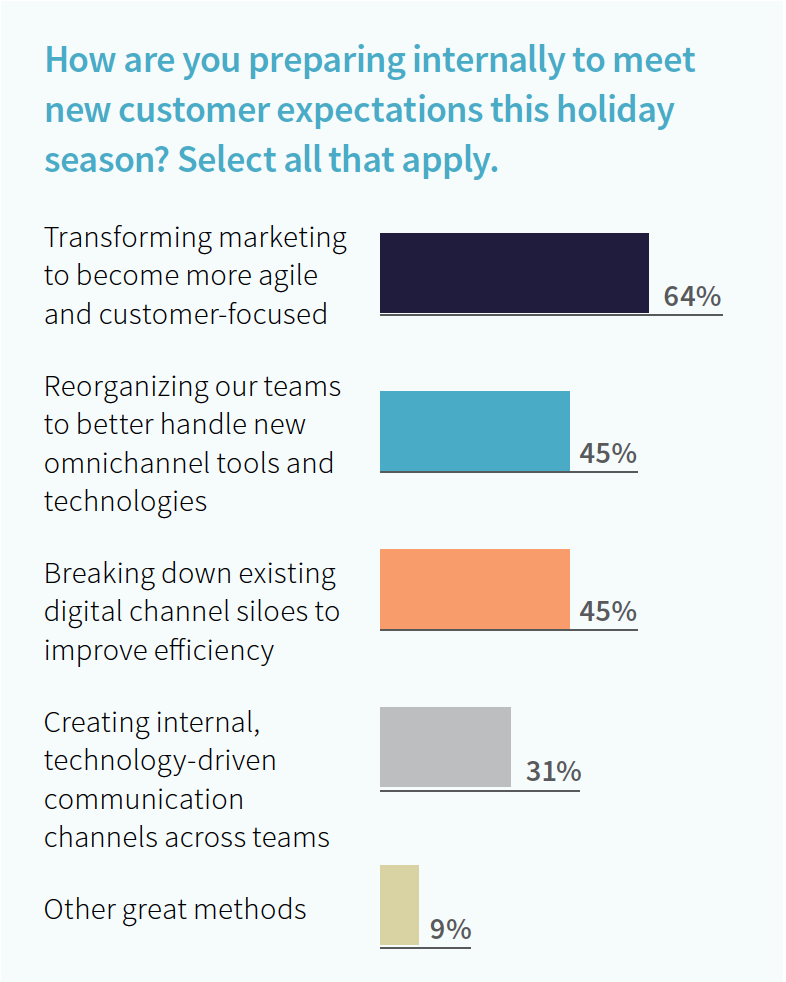

Respondents were asked how they are preparing internally to meet new customer expectations this holiday season. 64% of retailers are transforming marketing to become more agile and customer-focused—the most popular choice among the five methods measured.

Consumers are now more contextually aware of both the quality and prices retailers offer. Although retailers’ high standards won’t change, their pricing needs to respond to consumers’ unique circumstances to capture all opportunities during the holidays.

Adopting new back-end strategies and technologies that integrate online and offline environments is important for meeting customers’ omnichannel expectations. In each case, nearly half of retailers are reorganizing their teams to better handle new omnichannel tools and technologies (45%) or breaking down existing digital channel siloes to improve efficiency (45%). About one-third of retailers (31%) are creating internal, technologydriven communication channels across teams to prepare internally.

Innovation is stretching from customer-facing teams, tools, and technologies into back-end operations and the supply chain. As we will see in our checklist, centralizing resources and breaking down silos is critical as well.

CHOOSING CUSTOMERS OVER CHANNEL-CENTRICITY

Retailers have launched some innovative approaches to differentiate themselves from their competitors during the holidays. Nordstrom, for example, provides concierge services in some flagship stores. They plan to further develop these value-added services so that their relationship with customers does not end after their purchases.

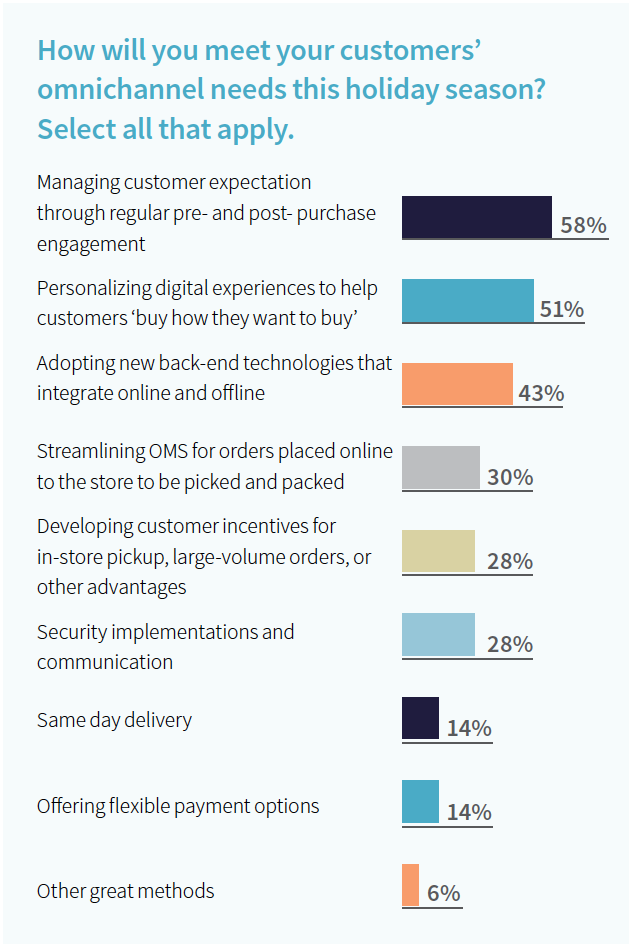

In fact, managing customer expectations through regular pre- and post-purchase engagement (51%) and personalizing digital experiences to help customers ‘buy how they want to buy’ (58%) are among the top priorities for meeting customers’ omnichannel needs this holiday season—the only majorities when retailers were asked how they will meet customers’ omnichannel needs.

Retailers continue to prioritize leveraging physical stores to fulfill digital orders and encourage large-volume holiday sales. Streamlining OMS for orders placed online to the store to be picked and packed (30%); developing customer incentives for in-store pickup, large-volume orders, or other advantages (28%); and security implementations and communication (28%) are popular methods among more than onequarter of retailers, in each case.

Fewer retailers are prioritizing sameday delivery (14%) and offering flexible payment options (14%) to meet customers’ omnichannel needs—a shift from the previous year. 1Six percent cite other methods, including interactive kiosks and spending marketing dollars in a more targeted way.

Other retailers are prioritizing fulfillment and supply chain divisions to prevent crises involving ‘out of stock’ and delay in delivery times, which may have costed them customers in the previous year.

THE ROLE OF TECHNOLOGY IN RETAIL INNOVATION

Several retailers admit they didn’t do enough to innovate with consumer-facing technologies in the previous year. Now, retailers will evolve their tech-based capabilities to meet consumer expectations; even if it’s just for the holidays.

Respondents were asked which future-tech assets they will use this holiday season, and which among them they will use only for the holidays. While most were satisfied with their 2017 technology investments, several claim they didn’t do enough to measure the results of their investments.

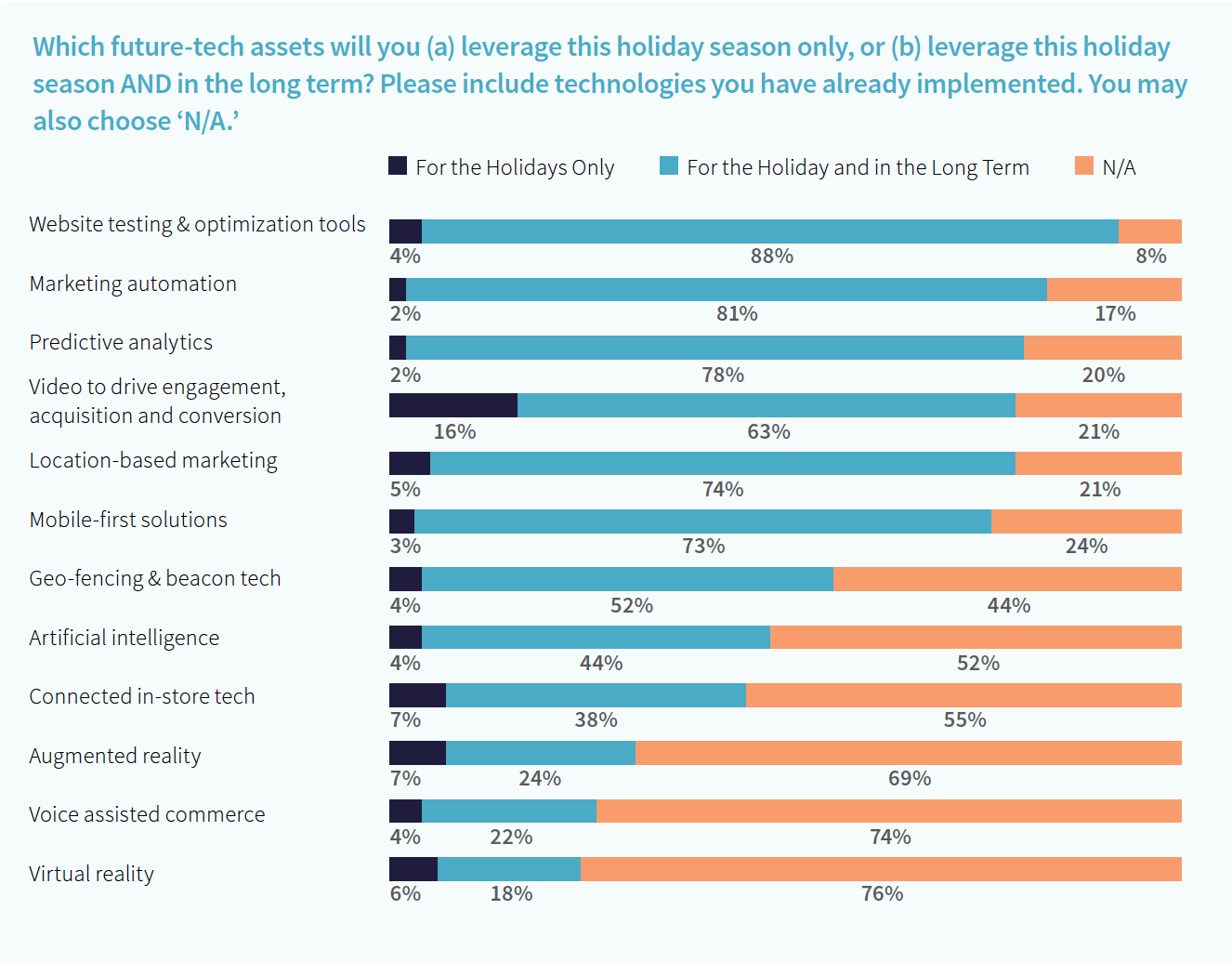

Now, nearly all retailers will leverage website testing and optimization tools (92%), among which 88% will use these technologies indefinitely. (4% will use this technology only during the holidays.)

Eighty-three percent will use marketing automation, and 80% will leverage predictive analytics during the holidays. In each case, 2% will use these technologies only during the holidays, indicating each is part of a longterm strategy.

While 79% of retailers will use video to drive engagement, acquisition, and conversion during the holidays, 15% among them will use this technology for this purpose only during the holidays—the largest of any group to do so with any technology measured.

Most retailers will use technologies driven by mobility and location data both during the holidays and in the long-term. Eighty-one percent will use location-based marketing, and 76% will use mobile-first solutions during the holidays. Fifty-six percent will use geo-fencing and beacon tech, where 4% will use this only for the holidays. These results are indicative of their increased focus on using digital to drive in-store interactions.

Less than 50% of retailers will leverage the remaining technologies in each case, indicating remaining questions about affordability, viability, or practicality. Among next-gen technologies, 48% will use artificial intelligence (AI), 45% will leverage connected in-store tech, and 31% will use augmented reality (AR) during the holidays. Fewer will use voice-assisted commerce and virtual reality.

THE ETAIL 2018 HOLIDAY CHECKLIST

Holiday strategies may differ from retailer to retailer, but some are more widely acknowledged than others. The eTail 2018 Holiday Checklist includes respondents’ highest-rated best practices, as well as other results-driven methods identified throughout the study (see Appendix).

Most items on the list were selected by majorities of retailers. The 10 topics are grouped based on popularity and relevancy, arranged in a logical order to help every retailer consider their best approach to success in Q4 2018.

- Define what the ideal customer experience will look like this holiday season. Generally, transition your strategy from a channel-centric to customer-centric approach.

- Create a centralized system for data, analytics, and automation that all teams can use. Adopt new backend technologies that integrate online and offline. Break down existing digital channel siloes to improve efficiency.

- Reorganize your teams to better handle new omnichannel tools and technologies. Create internal, technology-driven communication channels across teams.

- Transform marketing to become more agile and customer-focused.

- Integrate your in-store and online systems to provide more personalized experiences across channels. Track customers as they move between channels and act upon the resulting data.

- Take advantage of omnichannel opportunities—use digital channels to transform or streamline in-store experiences. Personalize digital experiences to help customers ‘buy how they want to buy’.

- Manage customer expectations through regular pre- and post- purchase engagement.

- Drive social media engagement through personalization, dynamic content, and social selling. Prioritize video to drive engagement, acquisition, and conversion.

- Dedicate resources to reducing fulfillment time. Ensure your stores are equipped from a staff and space perspective to fulfill online orders.

- Use future-tech assets like VR, AR, and intra-store echnologies to delight customers and distinguish your brand.

HAPPY RETAILING!

During the holidays, the most critical aspect of a retailer’s strategy is a willingness to embrace the season. No amount of technology and investment can make up for a lack of natural, human engagement so often sought this time of year. One major electronics retailer believes that fundamental to customer engagement is making them feel more appreciated, which can resonate their messages of value to other potential consumers. While you’re focusing on KPIs, targeting, and optimization, don’t lose sight of the natural connections that bind us together—consumers and retail professionals alike.

ABOUT THE AUTHORS

We launched eTail in 1999, and have been dedicated to supporting the growth of the retail industry ever since. What started off as 100 people in a room discussing where this sector is headed, has led to 2,000 senior-level eCommerce executives being inspired whilst learning and developing their company as well as their careers.

We are a team of writers, researchers, and marketers who are passionate about creating exceptional custom content. WBR Insights connects solution providers to their targeted communities through custom research reports, engaged webinars, and other marketing solutions. Learn more at: www.wbrinsights.com

ABOUT OUR SPONSOR

ShipStation is the leading web-based shipping solution that helps e-commerce retailers import, organize, process, and ship their orders quickly and easily from any web browser. ShipStation features the most integrations of any e-commerce web-based solution with over 150 shopping carts, marketplaces, package carriers, and fulfillment services. ShipStation’s many integration partners include eBay, Jet, PayPal, Amazon, Etsy, BigCommerce, WooCommerce, Shopify Plus, Squarespace, and Magento. ShipStation also integrates with carriers such as FedEx, USPS, UPS, Canada Post, Australia Post, Royal Mail, and DHL. ShipStation has sophisticated automation features such as automated order importing, custom best practice rules, product profiles, and fulfillment solutions that enable its users, wherever they sell and however they ship, to be exceptionally efficient at shipping orders. ShipStation is a wholly-owned subsidiary of Stamps.com (Nasdaq: STMP). For more information, visit ShipStation.com

APPENDIX

WORKS CITED

1 Sides, Rod. 2017 Deloitte holiday retail survey: Retail in transition. Deloitte Insights. October 23, 2017.

https://www2.deloitte.com/insights/us/en/industry/retail-distribution/holiday-retail-sales-consumer-survey.html